- September 9, 2015

- by Prakash Lohana

- Articles

- 373 Views

- 0 Comments

Mutual Fund is a common pool of money, where large number of investors, invest their money and then that money is invested in stocks, bonds, gold, money market instruments and other types of securities. So Mutual fund is not an asset class in itself like equity, debt or gold but it is a means to invest in different asset classes.

The ownership of the fund is thus joint or “mutual”; the fund belongs to all investors. A single investor’s ownership of the fund is in the same proportion as the amount of the contribution made by him or her bears to the total amount of the fund.

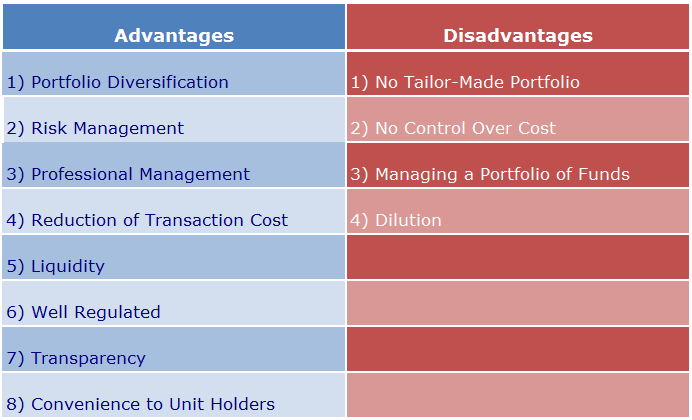

Legal structure of Mutual Funds is that of trust, which accepts savings from investors and invest the same in diversified financial instruments in terms of objectives set out in the trusts deed with the view to reduce the risk and maximize the income and capital appreciation for distribution for the members. A Mutual Fund is a corporation and the fund manager’s interest is to professionally manage the funds provided by the investors and provide a return on them after deducting reasonable management fees.Following chart summarizes advantages and disadvantages of Mutual Funds,Which are explained below.

Let us see advantages of Mutual fund:

1) Portfolio Diversification: As discussed above, Mutual fund is a common pool of money. So when a large number of investors invest their money in a Mutual Fund Scheme, they become joint owners of this scheme and then that scheme will invest in to number of securities as per the objective of the scheme. Mutual funds help investors to get diversified at two levels. First diversification happens at Asset class level because different mutual fund schemes have different objectives, some of them may invest in Equities, some may invest in Gold and bonds. An individual investor can invest into different type of schemes and get diversified into different asset classes easily. The second level of diversification happens at securities level for investors. Like a scheme which is investing into shares and stocks will invest in to shares of many different companies. An Equity mutual fund will generally have a portfolio of around 30 to 40 stocks. So when an investor invests in an equity fund he automatically gets diversified to 30 to 40 stocks. When we invest in 5 equity funds we may get diversified to the shares of more than 100 companies (considering some companies will be common) . It is very difficult for an individual investor to understand prospects of 100 companies and to invest in 100 companies and continuously do a research on them to take decisions of buying selling.

So by investing in Mutual funds an investor gets diversified to different asset classes and securities.

2) Professional Management: Mutual Fund companies appoint highly qualified fund managers and research analyst for continues research and effective management of portfolios of different scheme. Also it uses highly expensive technologies for such research and analysis. When an individual investor carries his own research on different securities for his own investment, it is very difficult that he can meet the same excellence level which those professionals are maintaining due to their education, experience, use of technology and team work. In our day to day life we use services of many professionals like doctors, Chartered Accountants, Lawyers, Architects etc. similarly when it comes to investing in different asset classes and securities we should use services of these professionals. So by simply investing in different mutual funds an investor is getting service of all these professionals. This professional management helps investors to reduce risk and improve on returns.

3) Effective Risk Management: Risk Management is the most important aspect of investing and as discussed above, due to proper diversification and professional management of funds by fund management team in mutual funds, different type of risks reduces significantly. By diversification into different asset classes and securities the risk of investor reduces significantly. On the other hand, professional management by fund managers and research analyst further reduces the risk.

4) Reduction of Transaction Cost: All the type of costs related to fund managers, research analyst, expensive technologies or use of different entities like custodian, Registrar & Transfer agents etc. gets spread over large number of investors and huge amount of investments so their effect to individual investors reduces significantly which helps to reduce overall cost on an individual investor.

5) Liquidity: When individual investors are holding securities and they want to liquidate those securities, sometimes they find it difficult to liquidate them immediately. Whereas in case of mutual funds when an investor wants to sell his units, mutual funds themselves buy them from investors in case of Open-ended schemes. In case of close ended schemes investor can sell them on stock exchanges where that scheme is listed. So mutual funds offer relatively easy liquidity options.

6) Well Regulated: All Mutual Funds are registered with SEBI and they function within the provisions of strict regulations designed to protect the interests of investors. All the schemes are approved by SEBI and it continuously monitors functioning of the Mutual Funds.

7) Transparency: Mutual funds operate in a very transparent manner. They have to give different disclousers related to NAV, portfolio of schemes, expense ratios etc. to the investors, as per norms of SEBI. So investors get all the kind of information about their funds.

8) Convenience to Unit Holders: Mutual Funds offer convenience to investors in investing in different asset classes and different kind of securities at one window. All the processes are designed in a manner to provide operational convenience to investors. All the responsibilities like maintaining record of different securities, buying- selling securities timely, collecting interest and dividend of different securities in which schemes have invested etc. is on Mutual funds and not on individual investors. This makes an individual investors life easy.

Disadvantages: Also there are some disadvantages of investing through Mutual Funds, which are listed below.

1) No Tailor-Made Portfolio: Mutual fund is a pool of money so the portfolios of mutual fund schemes are created as per the objectives of the schemes and they a generalized. It is not possible to create a customized portfolio for an investor as per his choice. However, Mutual Funds offer different schemes with different investment objectives like in Equity oriented schemes they offer schemes investing in Large Cap stocks, Mid Cap stocks etc. So investors get a wide choice to select the schemes.

2) No Control Over Cost: Investor has no control over different types of costs incurred by the asset management company. He is charged fund management fees as long as he remains in the schemes. However, these fees are charged as per the regulations formed by SEBI and these fees are not significant against the benefits offered by Mutual funds. On the other hand, if an investor directly tires to higher such professionals for management of his fund the cost will be unbearable. Against that the cost he pays here is reasonable and bearable.

3) Managing a Portfolio of Funds: Due to availability of large number of schemes, investors sometimes get confused in choosing right scheme for themselves. This leads to investing in schemes which may not suit their objectives or investing to large number of schemes which they are not able to track. This can be managed by consulting qualified financial advisers.

4) Dilution: Although diversification is very important but investing in too many securities by mutual fund schemes sometimes leads to over dilution in portfolio which also dilutes the returns. So by investing in mutual fund schemes, portfolio of investors don’t go up sharply when an individual stock or security gives a high returns run but at the same time it doesn’t fall sharply when an individual security or stock falls sharply.

Conclusion: From above discussion it is very clear that mutual funds are effective tools to take allocation to different asset classes and securities. They offer variety of advantages against investing directly in to different securities. There are small disadvantages also which can be managed by consulting qualified financial advisers. So rather than taking allocation to different asset classes and securities directly, investors should take the route of Mutual Fund Schemes.