- March 3, 2016

- by Prakash Lohana

- Articles

- 178 Views

- 0 Comments

As discussed in my earlier post “Inflation: Biggest Enemy in your Financial Life.” Inflation is one of the most signifacant risk to once fiancial life, now the question is how to fight with it?

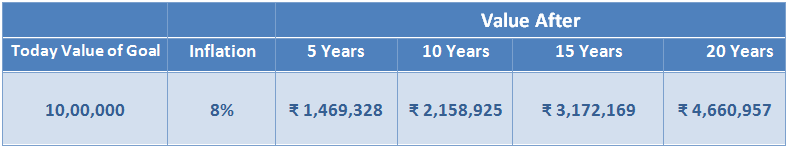

First of all investors need to recognize the impact of inflation on their long term goals. Most of the times while planning for their financial goals investors either don’t consider inflation or try to consider it in ad hoc manner which is wrong. When you consider 8% inflation it is compounded 8% p.a. and not simple so your cost will double almost in every 9 years. It has a very slow but significant impact on our Financial Goals. Below chart will show you the value of goal increases at 8% inflation over the years.

Now let us discuss some important aspects of investing to fight with the inflation.

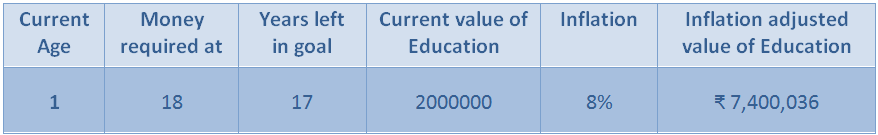

Start Early: Most importantly to fight with the inflation, you have to start saving for goals as early as possible. More you delay, more it will be difficult for you to achieve that goal. Let us take an example of education goal discussed in my last post.

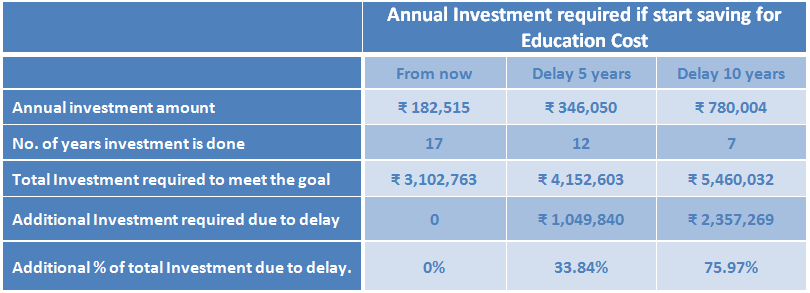

From above chart it is clearly evident that goal value reaches to 74 lacs from 20 lacs in a period of 17 years. Now let us see how much investment is required at 10% returns on investment to achieve the goal of Rs. 74 lacs if we start investing from now, delay the investment for 5 years (Start the investment for the goal when child is 6 years old) or delay the investment for 10 years (start the investment when the child is 11 years old).

In above table in option A the investor selects to save for the goals from now. So he needs to invest Rs. 1.83 lacs every year for next 17 years and total investment required is Rs.31.02 lacs. Whereas if he starts after 5 years( as shown in Option B) he will have to save for 12 year only but annual investment required to achieve value of Rs. 74 lacs will be 3.46 lacs and total investment required is 41.52 lacs . So delay of 5 years increases the total investment required by around 10.50 lacs (41.52-31.02) which around 33% more than Option A when investment for the goal is started immediately. In C investment starts 10 years late as compared to A and so the annual investment required is 7.80 lacs and total investment required to achieve the goal is 54.60 lacs which is 23 lacs (76%) higher as compared to option A . So the earlier you start better you will be to beat inflation.

Try to Earn High Real Returns : Indian investors are traditionally fond of investing in fixed deposits and gold. Typically returns in these asset classes range between 7% to 9% p.a. and inflation in different goals is also somewhat similar to returns so they end up earning very low real returns.

If you are investing Rs. 100 in 8% fixed deposit and inflation is also 8% then after one year you will get Rs. 108 from your fixed deposit and due to inflation goods or services which you are able to buy today with Rs.100 will also be available for Rs. 108 so actually you have just maintained value of money and not earned any returns.

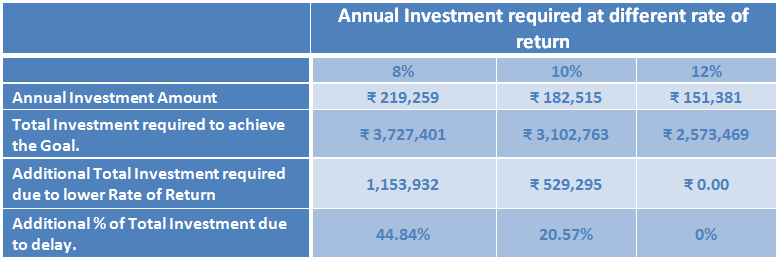

Let us once again take example of education goal discussed above. To achieve education goal of Rs. 74 lacs after 17 years if investment is started right now, Let us see how much investment is required if rate of return on investment made is 8%, 10% and 12%.

As shown in above chart, at 12% Rate of Return annual investment required is 1.51 lacs and total investment required is 25.73 lacs where as at 10% Rate of Return annual investment required is Rs.1.82 and total investment required to achieve goal is 31.02 lacs. So at 10% Rate of Return on investment , total investment required increases by 5.29 lacs which is 21% higher as compared to investment done at 12% Rate of Return. Similarly in case of investment done at 8% returns annual investment required is Rs. 2.19 lacs and total investment required to achieve the goal is 37.27 lacs. So at 8% Rate of Return one has to invest Rs. 11.53 lacs more to achieve education goal as compared to investment to be done at 12% Rate of Return.

Now, you may have a question that how to achieve 10% or 12% Rate of Returns. So for your long term goals inflation is the most significant risk and to beat it you should be investing a part of your investment in asset classes like equity which can give you higher returns and then rebalance your portfolio between equity and debt. IF you have investment horizon of more than 5 years then a significant part of your total investment should be invested in Equity oriented Mutual Fund. Please do remember that for deciding how much should be invested in equity? and how it should be rebalanced? You should take the help of a qualified financial planner.

Equity as an asset class contains risk of volatility but it helps you to beat inflation and for your long term goals you should take risk of volatility and not inflation. For Financial goals which are short term you should not take risk of volatility. Most of the time investors don’t consider inflation as a risk, which is a big mistake that they do.

To conclude with, to fight with inflation you have to earn high real returns and start investing as early as possible.