- November 12, 2014

- by Prakash Lohana

- Articles

- 7mins read

- 576 Views

- 0 Comments

Normally I have seen that when it comes to investing in different asset classes, every investor is confused about how much should I invest in asset classes like Equity where the risk is high and how much should I invest in asset classes like Bonds where the risk level is low and most of the times the clients who come to me for their financial planning are either under invested or over invested in aggressive asset class like Equity. There are very few investors who have ideal allocation in all Asset Classes. Deciding how much allocation should be taken in which asset class depends upon investor’s Risk appetite and his risk appetite is decided by doing his Risk Profiling. So this article is an effort to explain what is Risk Profiling and different factors on which Risk profiling of an investor depends.

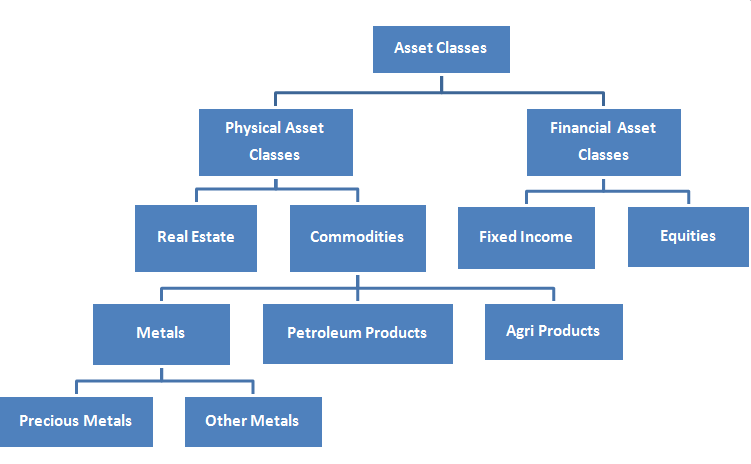

Risk profiling is the process of deciding an optimum risk level that an Individual Investor should take in his investments. As shown in above picture Asset classes are divided in to two segments, Physical and Financial asset classes. Within Financial asset classes you have two options: – Equity and Fixed Income and in Physical asset classes you have Real Estate and commodities. Now every investor has to decide an optimum mix of these asset classes for himself. For deciding his optimum risk level, investor has to decide his risk appetite and for this he has to do his risk profiling. The risk level that an individual investor should take depends upon three major factors which are as under.

1.Capacity to Take Risk: This depends upon risk taking capacity of an investor depending upon his circumstances. For example, an investor who is 35 years old generally has higher ability to take risk than an investor who is 75 years old. While deciding ones risk taking capacity there are numbers of factor which needs to be considered. Here below I have mentioned a few of them.

- Age: One of the major factors in deciding risk taking ability is age. Normally higher the age, lower the ability to take risk. But this is not always true. Let me give you an example to explain this. Recently I was writing financial plan for a young doctor who just completed his Post graduation and about to start his working life. He has financial objectives which are very short term like marriage, buying a house and planning for his clinic. So all these objectives are very short term and so we cannot invest much money for long term and cannot take much exposure in Equity kind of asset classes.

- Investment Horizon: Investment horizon plays major role in deciding risk taking capacity of an investor. Say if an investor is investing for 15 years then he has long term period so he can take higher exposure to aggressive asset classes like equity and real estate. But if he is investing for 2 years only then he has limited time so he should not invest in risky asset classes and his risk taking capacity is low. Longer the investment horizon, higher the risk taking ability and lower the investment horizon, lower the risk taking ability.

Other factors that contribute in deciding risk taking ability are type of income, health conditions, number of dependents in a family etc.

2.Need to Take Risk: Need to take risk is another financial character that decides optimum risk level for an investor. Let me explain you Need to take Risk with an illustration to make it simple. There are two investors Mr. A and Mr. B.

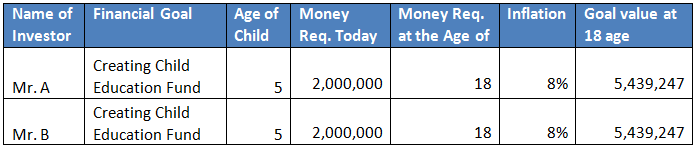

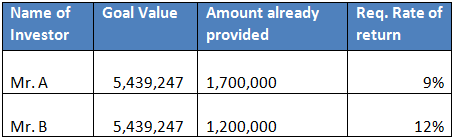

In above illustration Mr. A and MR. B have same goal. They have a 5 years old kid and education fund required in today’s value is Rs. 2000000/- and fund will be required at 18 years of age. Inflation is assumed to be 8%. Final goal value is around Rs. 54.39 lacs to be achieved. I have purposefully kept all the factors same for better understanding. Now look at below table.

In above case both Mr. A and Mr. B have same goal value but Mr. A has already provided Rs. 17 lacs for above goal and Mr. B has provided only Rs. 12 lacs. So for remaining period of 13 years Mr. A can easily achieve the goal only by investing this fund of Rs. 17 lacks at 9% p.a. returns which is quite easy to achieve and can be achieved with very low equity allocation say by investing between 10% to 20% in Equity and rest in Bonds. Where as for Mr. B to achieve this goal by investing this fund of Rs. 12 lacs, he will have to invest at 12% p.a. and for this he will have to take high risk and invest more than 50% in Equity. So in his case need to take risk is high.

To simplify further in case of an investor who has lots of accumulated wealth compared to his financial goals, need to take risk is low so logically he should take less risk and allocate less money in high risk asset classes like equity and investor who has relatively low accumulated wealth against his financial goals has need to take high risk and so he should logically allocate more money to risky asset classes like Equity.

3.Willingness to take Risk: Capacity to take Risk and Need to take risk are two financial characteristics of the investor where as Willingness to take Risk is a psychological character of an investor’s risk profiling. Willingness to take risk is basically investor’s psychological comfort level with the risk.

Psychological comfort level means how comfortable are you with volatility in underlying asset class in which you are investing. If you have invested 50% of your assets in Equities and equity market falls by 20% your equity assets can easily fall by 20% or even more than that and your total portfolio can also fall by around 10%. Are you comfortable with this fall or volatility psychologically? If you feel disturbed and cannot sleep in the night or cannot focus upon your work than you have chosen higher risk level than you ideally should and you should lower down your equity allocation.

How to improve your Psychological comfort level with different Asset Classes: I would like to share my experience as Practicing Financial Planner here. When investors come to me for their financial planning, I realize that their understanding about basic financial concepts is very poor because in India we don’t have any formal education on personal finance in any education streams like Engineering, Medicine etc. so due to poor understanding about basics they are afraid of taking risk. So first of all I try to develop a basic understanding about asset classes and try to explain them basic things about asset classes, investment, their characteristics and then make them understand about what is risk? And how to manage risk. Once this understanding is developed they are comfortable with risk and after that we decide upon clients comfortable risk level.

Willingness to take risk should not change with market conditions: Many times, I have observed that in the times when Equity markets are doing very good, investors invest major part of their wealth in Equity and when equity market fall they reduce their allocation to equity and divert towards other asset classes which are doing good at that time. So this shows that willingness of investors keep changing with sentiments. This is very dangerous factor and every investor should be cautious about this and see that your willingness should not change as per your sentiments because this will affect your investment decisions adversely.

Many financial planners use some psychometric test questioners to measure willingness of investors to take risk but I am of opinion that those questioners don’t take you to right conclusion.

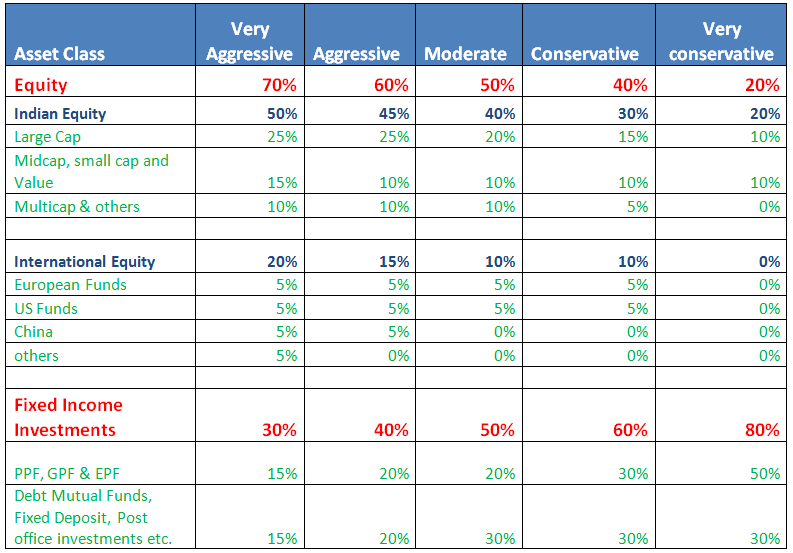

From the above three factors, Capacity, Need and Willingness to take risk, optimum risk level of the client is decided and accordingly his investments are allocated to different asset classes and managed accordingly. Most of the financial planners profile their clients in following five categories ranging from Very Aggressive to Very Conservative and then within that category, optimum allocation to different asset classes is given.

Conclusion: Risk profiling is a very important part of financial planning. It plays a very important role in the construction of portfolio of every investor. Without completing your Risk Profiling process you cannot know your optimum risk level and what allocation should be given to different asset classes and as a result you cannot create a portfolio which is good for you.

Many times I meet investors where there is need to take higher risk and also there is ability to take high risk but they have not taken the level of risk that they can take due to some or other reason or sometimes they don’t know about their allocation in different asset classes. Similarly sometimes I find clients who don’t have ability to take high risk have taken high exposure to asset classes which are very risky. So I would recommend investors to approach qualified financial planners and go through risk profiling process so that based on above three factors they should know optimum risk level for themselves and accordingly create their portfolio.